Why do they need to do that, given that you are using PayMaker and carried out the two required rollovers (June 31st 2017 and 31st December 2017)?

The reason for this is that there were two different tax rates in 2017. We had emailed the following to FRCS on August 16 2017.

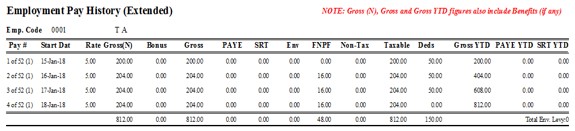

As you are aware, due to the tax change in the middle of the year, and the treatment of 2017 as 2 tax years, it is highly likely that the PAYE as Final Tax will not work as well as required i.e. some tax payers will be eligible for a refund while others will need to make additional payments (due to insufficient deductions at source). This can happen for both PAYE and SRT (and possibly for the new ECAL).

The response from FRCS has included the following:

Fully agree with your comments. Whilst this has not been addressed as yet, I can assure you that we will work along these lines:

- 2017 tax calculations for individuals will be a challenge.

- FRCS fully appreciates this.

- Penalties will not be charged for short deductions unless there is deliberate attempt to defraud the system.

- Refunds will be issued for any over deduction.

As you can see from the above, FRCS are aware of this issue. Unfortunately, there was no solution available to this problem (in terms of a formula to get the correct final tax) and as a result, some employees will need to pay additional tax while others may get refunds.