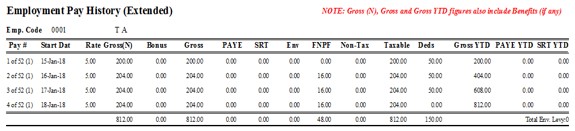

If you want to check an employees pay history, or check if the PAYE was

calculated properly, you need to print the Employee Payment History

(Extended) report. This report has all the relevant information that can be

used with the spreadsheet provided by FRCA to see if tax calculation were done correctly.

You can print out the report using the following steps:

- Open PayMaker.

- Go to reports.

- Select Other Reports.

- Select Employee Payment History Extended report.

- Enter a valid date in Date From and To.

- Select an employee from the drop down list on the screen.

- Click the Preview button to see a Report similar to the one below.

If you have any questions, please contact us at our office on 330 4554.